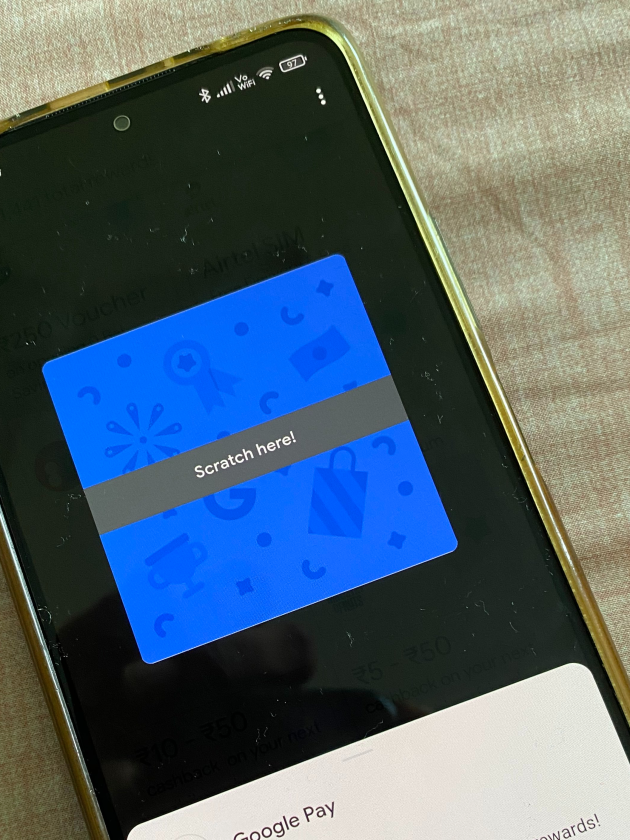

Gone are the days when we transferred money through G-Pay (erstwhile Tez) and got more than Rs.10 as cashback (then the newly introduced ‘scratch card’). Later, instead of burning cash, it shifted to offering discount vouchers of restaurants, delivery, or financial services apps. Nowadays, cashbacks are distant while the frequency of discount vouchers, too, has reduced by a lot. This has happened across all types of payment apps as well as other startups.

Millennials, including me, have been great fans of all those heavy discounts and cashback. We have even used each others’ credit cards for an offer or two. We got used to this subsidised urban lifestyle and now, all of a sudden, we are paying higher than before.

Who is the culprit?

The culprit is inflation. But inflation never comes alone. The interest rate is inflation’s plus one. For over more than two decades, especially in developed economies, inflation and interest rates have been at ultra-low levels. Then entered Covid. Low-interest rates lingered around until Covid dissipated. As soon as Covid risks receded, Russia-Ukraine war emerged that disrupted the world again. Then, sanctions, military aggression and commodities’ supply crunch on one hand and the reopening of economies, on the other hand, pushed inflation upwards. The streak of low inflation and low-interest rates broke in the first half of 2022.

“Listed startups have seen their valuations fall because of the threat of the rise in interest rates. As the future cash flows of such companies remain the same, the rising interest rate decreases the valuation of these companies, as evidenced by their stock performance”, writes Siddharth Pai.

Anyone interested in valuations must know this formula: Present Value = Future Discounted Cashflows. Present value has an inverse relationship with interest rates. When interest rates go up, present value declines, all else remaining same.

Higher interest rates have also hurt venture capitalists (VC) who have invested in startups like Uber, Zomato, Paytm, etc. VCs have changed their approach to dealing with the founders. A Mint article reported, “Investors are also asking founders to work towards stronger unit economics, reduce cash burn and think about business sustainability.” It means that companies will not give discounts the way they used to provide earlier. They will think twice before doing that because now they have to think more about cash inflow and less about attracting customers.

Millennial Lifestyle Subsidy

Derek Thompson writes in Atlantic, “For the past decade, people like me—youngish, urbanish, professionalish—got a sweetheart deal from Uber, the Uber-for-X clones, and that whole mosaic of urban amenities in travel, delivery, food, and retail that vaguely pretended to be tech companies. Almost each time you or I ordered a pizza or hailed a taxi, the company behind that app lost money. In effect, these start-ups, backed by venture capital, were paying us, the consumers, to buy their products. It was as if Silicon Valley had made a secret pact to subsidize the lifestyles of urban Millennials.”

Now, this subsidy is ending!

Other Signals

Recently, RBI sought public feedback on a host of charges levied in payments systems through a discussion paper ‘Charges in Payment Systems’. Although these charges have been brought in aiming at rationalisation, RBI is signalling at a potential end of the cheap economy era. This is happening at a time when the debate around freebies vs. welfarism is gaining traction across the political spectrum. Who knows, the one who initiated the debate could be pissed at Uber or Ola for not giving any further discount?

Future

Many people – economists, technology experts, venture capitalists and finance experts – see this as the end of the so-called ‘Millennial Lifestyle Subsidy’. The central banks around the world have accelerated rate hikes. Even though inflation tames a little in the near term, overall interest rates will remain high for at least a few years. All-in-all, it should be reasonable to assume that this will be the end of discounts and cashbacks.

But, companies will find ways to make you feel better. They might raise prices a little, give you a discount and you will go happy thinking that you have saved today.

– Swapnil Karkare

Sources and Further References:

Venture Capital is a Subsidy, Ryan Kulp

Unicorn valuations plunge as markets are rocked by macro turbulence, Pro Active Investors UK

As valuation dips, India has 5 fewer unicorns now, Business Line

Venture capital and the new era of inflation, Corniche Growth Advisors

Markets have fallen because the era of free money is coming to an end, The Economist

Inflation and Venture Capital Returns, Super Seed

As interest rates rise, startups and VCs are playing a new game, Tech Crunch

How interest rates affect Indian startups, Siddharth Pai, Money Control

Venture capital firms tighten funding tap of Indian startups, Economic Times

How RBI Rate Hike Will Impact BNPL Players, Digital Lenders, Inc42

The End of the Millennial Lifestyle Subsidy, Derek Thompson, The Atlantic

Farewell, Millennial Lifestyle Subsidy, Kevin Roose, New York Times

Millennials lament loss of pampered lifestyles as cost of luxury services soar, New York Post

Money for startups now comes with many strings attached, The Mint

RBI seeks feedback on payments charges for UPI, Cards, PPI, CNBC TV18