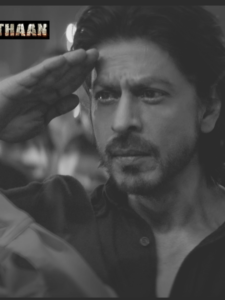

Will you love learning economics from the Badshah of Bollywood? If yes, then I have this video for you. FYI, Shahrukh is an economics graduate.

There are undoubtedly, many marketing and business lessons that one can learn from movie production. But within movies, some circumstances and events can teach us something or the other. In Pathaan, I found treasures of moral hazard and information asymmetry.

What did you find? In which other movies have you seen these two economic concepts? Mention them in the comments below.

TRANSCRIPT/SUMMARY

Apni khursi ki peti baandhlo kyunki mausam bigadne wala hai.

Ji haan mausam bilkul bigadnewala hai…because aaj se pehle aapne kabhi bhi socha nahi hoga ki pathaan movie se hum economics sikh sakte hai. Confused? Get ready for a segment which I would like to call ‘EconBolly’.

Hello everyone, I am your host Swapnil Karkare and this channel is all about learning and understanding economics and finance.

So, without wasting too much time, let us jump on the economics lessons from the movie Pathan – yes. lessons..there are 2 things Pathan teaches us.

Ok. So pehle hi disclaimer de raha hoo, that isme spoilers honge. Lets get started.

So in movie, there is a scene which shows that the government of India never negotiates with terrorists. The background story of Jim, the character played by John Abraham, is based on this philosophy of not negotiating with the terrorists. Why is this policy implemented in almost all countries in reality too?

Now, assume that in general, govts start negotiating with terrorists. Now, terrorists will know that they can demand anything. For example, they can ask for higher ransom, or they can ask to release a few militants, and so on and so forth. What’s wrong in it? This creates a dangerous situation because it may incentivize the terrorists to take more hostages in the future or to get their work done in a coercive manner. This will create disorder in the society.

Economists like to give names to certain things and this thing is called moral hazard.

Now let me give another example of moral hazard. If you have car insurance, you may be less careful when driving because you know that if there is any damage, then that will be covered by the insurance company.

Wait wait.. I know what will you say…that no one will drive carelessly just because of the insurance. Ahh.. may be…but may be not. Probably you wouldn’t do it. But but Joey Tribbiani can… You remember this..

People can behave differently when they are insured or protected from risks. So, that means, if we start driving carelessly because of insurance, then that will create problem, not only us and our families, but for insurance companies also. Because they may have to pay more claims than they anticipated. And therefore, if you read your policy carefully, you will see that insurance company doesn’t pay 100% of the damages. You have to shell out some proportion of it.

Let me give you another example. Assume a bank did some risky business and then got involved in a crisis situation. Now that bank needs to sell its assets so that it can give money back to its depositors like you and me…and also repay its other creditors and obviously the owners or shareholders. Now, assume there is a very big kind of scandal or crisis and the bank does not have enough money to give to depositors. So basically, if I am having a savings bank account in that bank, my money is at risk. So, what happens in such situations? In some countries, the government comes into the picture and says to depositors that – guys you dont worry, we are here for your service. So, dont be afraid, we will give your money back. Cool? I am happy that my money will be returned.

But what signal does it send to other banks. It tells other banks that you may not worry…you can also do some risky business, and in case you also face something similar then there is no issue, the depositors money will be taken care by the govt. And if this kind of govt intervention continues then it becomes very difficult to make banks more accountable for their own business.

Thats why we have deposit insurance system, where the banks pay insurance premium to a company which will basically refund the depositors’ money if the bank is in such dire situation. But there is always a limit to everything and so is for the deposit insurance amount.

For example, in India, the limit is Rs. 5lacs. So if bank is getting shut the depositors money will be returned upto only 5 lacs. What it does… It tells banks that – boss you cannot do risky business. Although your deposits are insured, they are not wholly insured. So beware of all the risks in your business, otherwise people will start withdrawing money from your bank if they smell something fishy.

So that was another of moral hazard from bank’s perspective.

This was the first lesson. But our Pathan Economics journey does not stop here. There is one more lesson, as I have already told you.

In the terrorists vs. govt situation – Let us assume that the govt pays some ransom or releases another terrorist which it has captured a couple of years ago against the release of hostages. OK?

But does the govt really really know that if after paying ransom, will they release the hostages…? Or what if the govt release hostages now and you come to know that the terrorists bombed some city a month later? So, in this situation, the govt does not have full information of what’s going on in the minds of terrorists.

This is a classic case of information asymmetry. The terrorists have more information about their true intentions and capabilities, while the government has limited information. And because of limited information, the govt might decide to negotiate with terrorists.

Wait wait.. have you seen similar situations in other movies.

Remember Or Zameer, starring Ajay Devgan and Abhishek Bachchan? Or Sonam Kapoor starrer Neerja? Or classic movie ‘A Wednesday’ starring Naseeruddin Shah and Anupam Kher? These movies have similar plots. A plane is hijacked and there are some demands from the terrorists that the govt had to fulfil. Or a bomb threat is given to release some terrorists.

Now, Information asymmetry is a situation where one party in a transaction has more information than the other party. This can be a problem because it can lead to one party making a decision based on incomplete or inaccurate information, which can result in negative outcomes.

Say, in A Wednesday, Anupam Kher, the cop, does not know true intentions of Naseeruddin Shah. And therefore, he was listening to his demands.

Now, let me give another example.

Assume you are all ready for a dream interview. In interviews, you get to know each other better. Company asks you questions and test your abilities. Then, at some point, you get to ask some questions like CTC, bonus, work life balance and so on and so fiorth. The answers to such questions are unknown to you. The company manager can tell you that you will get a 10% bonus and no work on weekends and what not. But they can lie. They know the real situation, which can be 14 hrs work daily, with some additional work on weekends, plus you will hardly be able to beat inflation with your salary increment.

So all this information is available to only the company but not you. But don’t be sad. You have more information about your own skill sets and ability and knowledge. The company might not know that you have faffed out in many questions or that you will be leaving the job in 6 months to pursue masters degree, eventhough you have faked the answer to the question – where do you see five years down the line…. So, there’s this information asymmetry in this transaction. Company doesnt know your intention of doing masters…and you dont know company’s intention of not providing a work life balance.

So, what to do… You can ask someone who actually works or have worked in that company…and the company also does all the background check along with the different levels of interview so that both – company knows you better and you know company better.

Now, in the context of movies or any spy movie, what we see is that there are agents planted by govt in terrorist organisations and also there are agents planted by terrorists in the govt. So here too, both want that additional piece of information which is missing link in their respective missions.

So, what did you learn from Pathan – apart from indisputable stardom of SRK are two bonus economic concepts i.e. moral hazard and information asymmetry. I am sure there might be numerous such concepts in the movie…and also, that these concepts might have been explained very well in other movies. But here’s my shot at explaining these concepts through Pathan.

Movies and pop culture, are undoubtedly the best entertainment form. But they are all central to humans, our behaviours and all the idiosyncracies we carry along. And economics, is in a way, study of human behaviour. And i believe that we can see many examples of many economics and financial concepts through movies.

I hope you enjoyed the episode. So please khursi ki peti bandh lo aur is podcast ko like, subscribe aur share karo. Thank you…see you soon.